ClaimsAgent – AI Assistant for Insurance Claims Management System

This project streamlined insurance claims processing by leveraging AI to improve decision-making, reduce manual workload, and enhance communication. The result was faster workflows for adjusters, lower operational costs, and improved customer satisfaction.

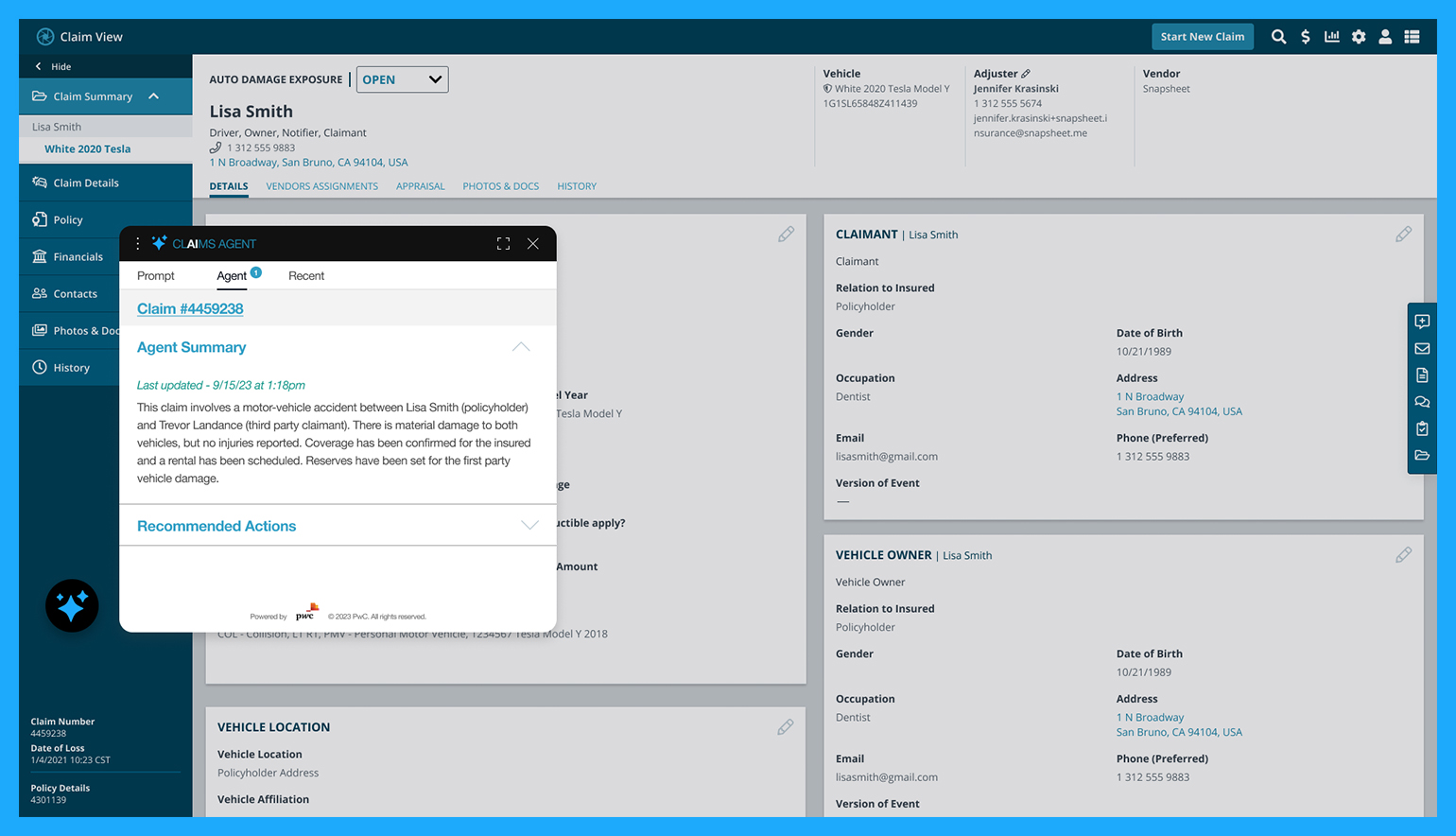

ClaimsAgent is an Agentic Conversational AI assistant powered by a large language model (LLM) like GPT, designed to support claims adjusters through natural language processing (NLP), intelligent recommendations, and workflow guidance. Built with human-in-the-loop oversight, it generates claim summaries, tracks progress, and integrates with existing systems—serving as a proactive, trustworthy partner in the claims process.

Client: ClaimsAgent

Industry: Auto Insurance

Platforms: Enterprise SaaS Application, Desktop, Web

Design Team: Myself, UX Designer, UX Researcher

Client Team: Stakeholders, Engineering Team, AI/ML Engineers & SMEs

Time Frame: 4 Months

AI Technical Project Collaboration — Engineering & AI/ML Engineering Teams

Assistant Integration Strategy: Partnered with engineering teams to define how and where the assistant would be embedded into the existing claims platform without disrupting adjuster workflows.

Interface Behavior Design: Collaborated on assistant triggers, confirmation flows, editable fields, and document upload interactions to ensure a seamless user experience.

AI Capability Development: Worked with AI/ML engineers to shape assistant functionality, refine prompt strategies, and align model responses with real-world claims scenarios.

Human-in-the-Loop Design: Co-designed review and approval patterns that allowed adjusters to confirm or override AI-generated suggestions, maintaining user control.

Decision Boundary Clarity: Defined clear roles between AI assistance and human judgment to foster trust and ensure accountability in high-stakes workflows.

Explainability and Grounding: Advocated for transparent responses grounded in real policy data and case context to improve adjuster understanding and confidence.

Resilience Across Edge Cases: Delivered detailed interaction flows and fallback scenarios to support consistent behavior in complex or unexpected claims situations.

Before & After

Context

Claims adjusters are the primary users of the insurance claims management system, responsible for managing insurance claims filed by customers.

- Review Insurance Claims: Evaluate claims to determine fault, verify coverage, and calculate settlement amounts.

- Oversee Case Resolution: Oversee critical tasks such as gathering documentation, finalizing decisions, and ensuring all required actions are completed efficiently.

- Maintain Clear Communication: Keep claimants informed with timely updates and transparent explanations throughout the claims process.

Problem

Claims Adjusters Impact:

- Overly Complex Workflows: Inefficient workflows made claim processing overly complex, leading to delays and frustration.

- Fragmented Systems: Limited access to decision-support tools made it difficult to determine fault, verify coverage, and calculate settlements accurately.

- Inefficient Communication: Inefficient tools caused delays, reducing customer satisfaction.

- Lack of Tailored Solutions: Existing systems failed to address adjusters’ specific workflows and challenges, creating inefficiencies and dissatisfaction.

Business Impact:

- High Operational Costs: Inefficient workflows and fragmented systems increased operational costs.

- Inconsistent Evaluations: Limited decision-support tools led to error-prone claim evaluations.

- Delayed Resolutions: Ineffective communication tools caused delays in claim resolutions, frustrating both adjusters and customers.

- Prolonged Onboarding: Insufficient training resources for new employees extended onboarding periods, reducing productivity and compounding inefficiencies.

Objective

- Streamline Claims Processing: Simplify workflows and automate repetitive tasks to improve operational efficiency and reduce processing time and costs.

- Leverage AI for Decision Support: Improve liability assessments and settlement accuracy through AI-powered tools, ensuring consistent and informed decisions.

- Empower Adjusters: Provide tailored tools and resources to enhance productivity, reduce mental strain, and improve job satisfaction.

- Enhance Customer Communication: Facilitate clear and timely communication through automated features, reducing delays and elevating customer satisfaction.

- Facilitate Seamless Onboarding: Provide training resources to accelerate AI adaptation and reduce downtime for new users.

UX Process:

Empathize

Tasks:

Reviewed Stakeholder requirements

Educated on Insurance industry

Conducted interviews with Claims Adjusters and Stakeholders

Shadowed Claims Adjusters

Performed product evaluation of current claims software

Stakeholder Requirements

Key Findings:

- Operational Efficiency and Customer Satisfaction: Create a system that boosts efficiency, streamlines communication, and enhances satisfaction while reducing operational costs.

- Enhanced System Capabilities: Focus on developing a user-friendly interface that supports adjusters of all tech levels, integrates seamlessly with existing systems, and utilizes AI to increase accuracy and reduce claims processing time.

- Compliance and Security: Prioritize meeting industry regulations and ensuring the protection of sensitive data within the system’s framework.

Insurance Industry

Key Findings:

- Claims Processing Techniques: Learned about various methods and best practices for efficiently handling and processing insurance claims, including steps for evaluating and verifying claim information.

- Regulatory Compliance: Gained an understanding of the regulatory framework governing the insurance industry, ensuring that the system meets all legal requirements and standards.

- Technological Integration: Explored how advanced technologies, such as AI and automation, are being integrated into insurance operations to streamline workflows and improve accuracy.

- Customer Satisfaction Metrics: Studied the key metrics used to measure customer satisfaction in the insurance sector, emphasizing the importance of timely communication and transparent claim resolutions.

Interviews & Shadowed Claims Adjusters

Claims Adjusters:

- Workflow Streamlining: Simplify workflows by reducing manual data entry and repetitive tasks.

- Decision Support Tools: Provide AI-driven liability recommendations and cost estimations to aid informed decision-making.

- Communication Tools: Enable clear, consistent communication with claimants and stakeholders throughout the process.

- Usability and Training: Offer a user-friendly interface that minimizes training time and maximizes focus on core tasks.

Stakeholders:

- Operational Efficiency: Streamline operations to cut costs and boost productivity in claims management.

- Regulatory Compliance: Ensure all processes align with industry regulations and legal standards.

- Customer Satisfaction: Enhance satisfaction through timely, transparent claim resolutions.

- Data-Driven Insights: Leverage analytics to identify claim trends and inform strategic decisions.

The biggest challenge I face is keeping track of all the details across multiple cases. A tool that organizes everything in one place would save so much time and reduce the risk of errors.

Ericka Willby - Senior Claims Adjuster

Usability Testing

These documents collectively represent a comprehensive series of moderated usability tests conducted on the ClaimsAgent Virtual Assistant, spanning early user research and interview planning to usability testing and onboarding design. Through in-depth discovery conversations and iterative evaluations of core workflows—such as claim submission, editing, status tracking, and document upload—the research identified key user needs around transparency, control, and efficiency. The findings shaped a product experience that reduces friction, supports adjuster confidence, and seamlessly integrates intelligent assistance into daily claims operations.

Discovery Insights Report: Interview guide and responses from conversations with claims adjusters to understand workflows, pain points, and expectations for intelligent assistant support. View Report >

Testing & Iteration Report: Moderated testing of how adjusters use the Virtual Assistant to submit, track, and edit claims, along with uploading documents and navigating system feedback. View Report >

UX Adoption Toolkit: Onboarding guide and one-page summary designed to help first-time users understand, trust, and confidently interact with the ClaimsAgent platform. View Report >

- Stakeholder Briefing Report: Internal FAQ and onboarding insights to align claims leadership, trainers, and IT support around ClaimsAgent’s purpose, user benefits, and successful rollout strategy. View Report >

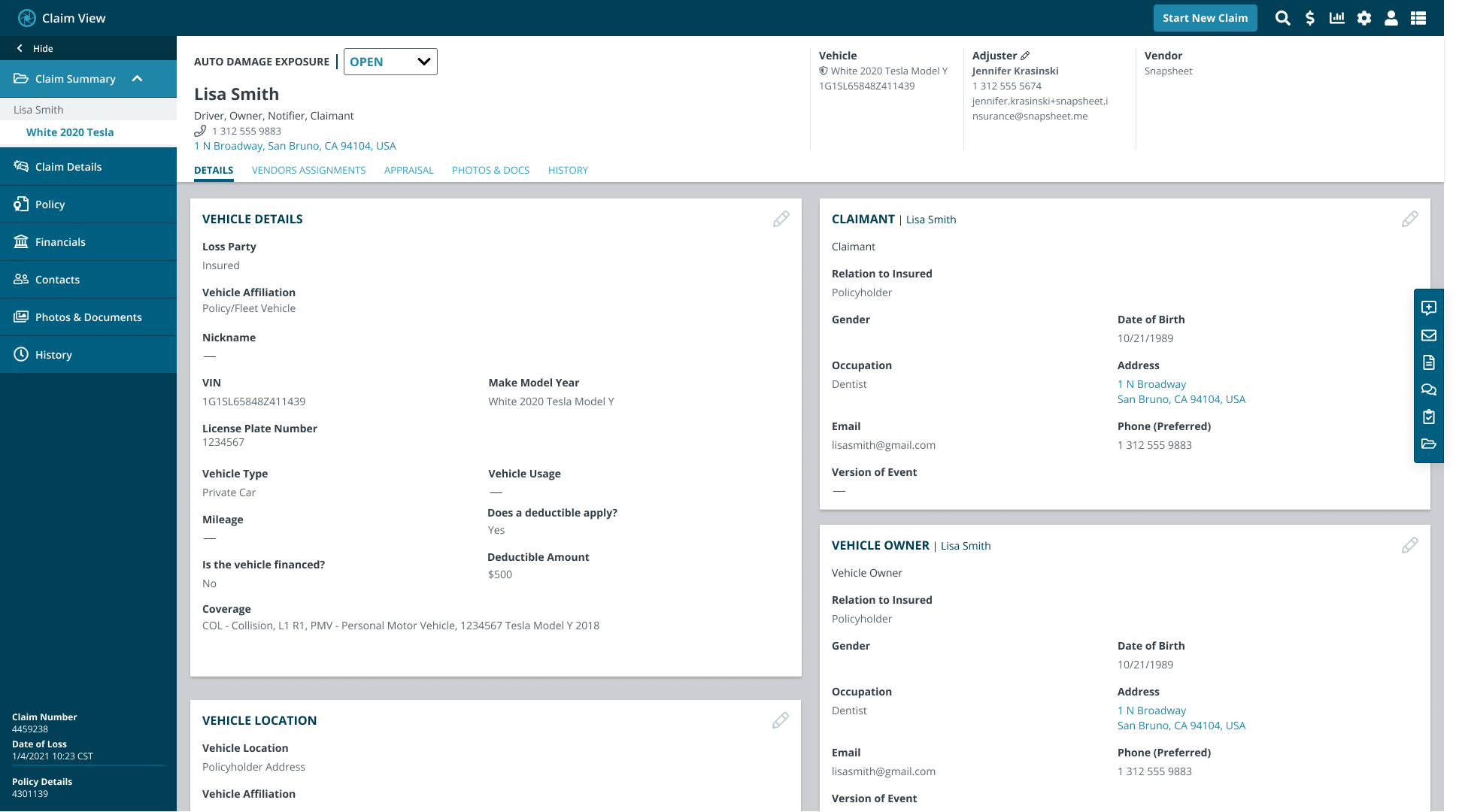

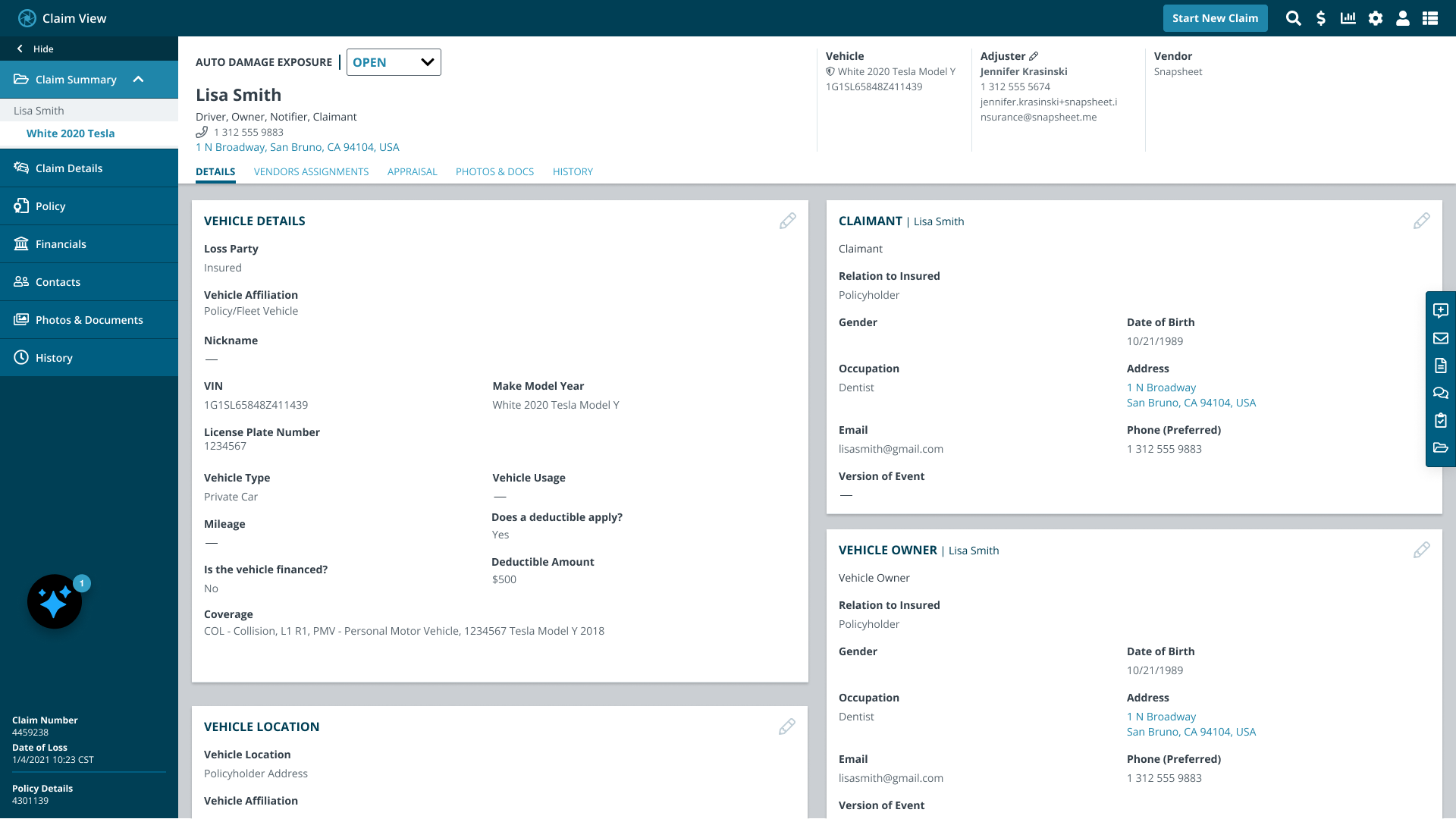

Product Evaluation

This system is used by Claims Adjusters to manage insurance claims processing and fraud detection. Adjusters manually extract and organize key details such as names, case IDs, addresses, and dates from emails and attachments. This process is time-consuming, prone to errors, and requires significant effort, slowing down claims processing and decision-making.

Conceptualize

Tasks:

Developed User Personas

Defined AI-Driven Features

Created User Flows with AI Integration

Developed Wireframes

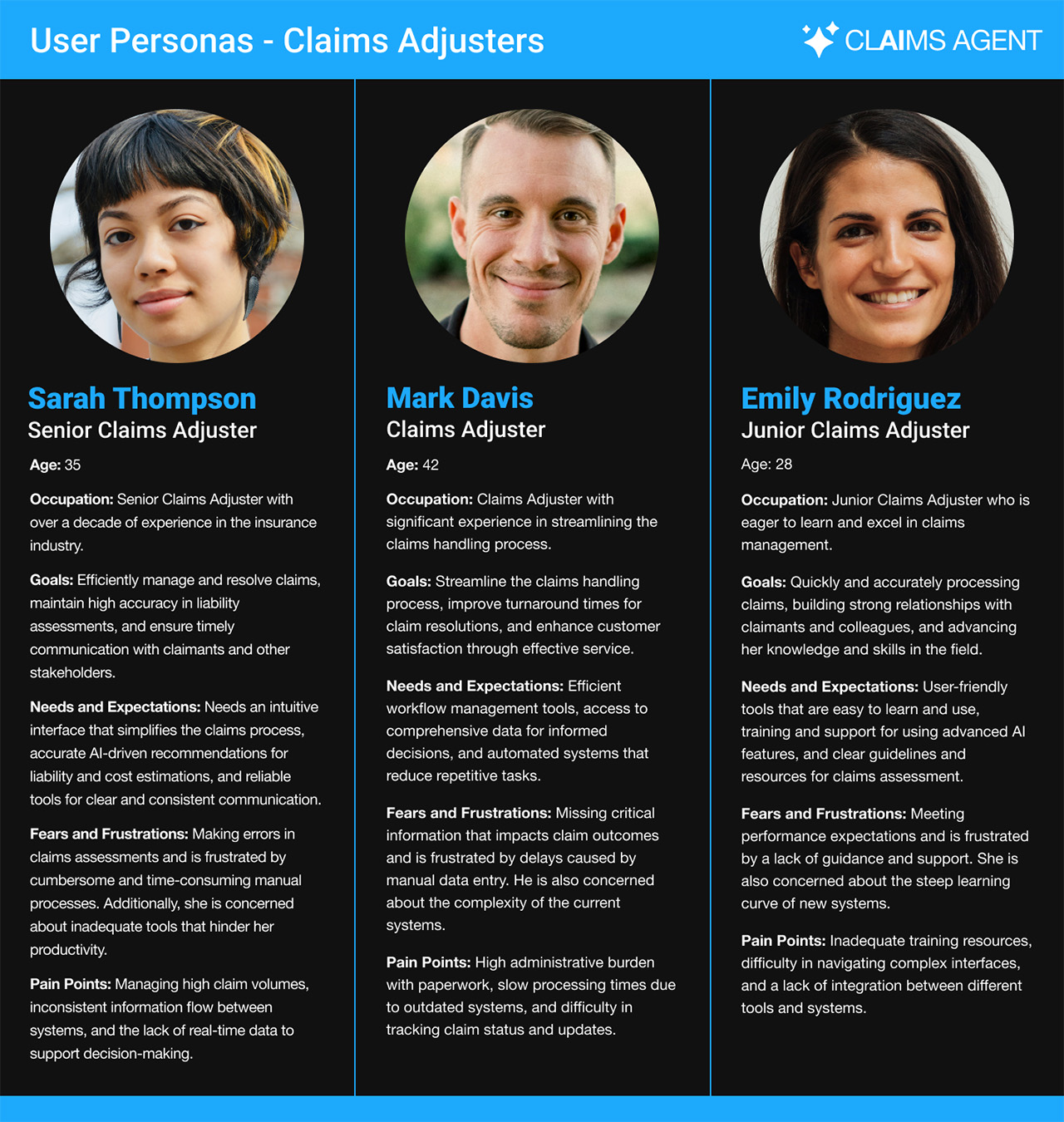

User Personas

Key Findings:

- Claims Processing Techniques: Learned about various methods and best practices for efficiently handling and processing insurance claims, including steps for evaluating and verifying claim information.

- Regulatory Compliance: Gained an understanding of the regulatory framework governing the insurance industry, ensuring that the system meets all legal requirements and standards.

- Technological Integration: Explored how advanced technologies, such as AI and automation, are being integrated into insurance operations to streamline workflows and improve accuracy.

- Customer Satisfaction Metrics: Studied the key metrics used to measure customer satisfaction in the insurance sector, emphasizing the importance of timely communication and transparent claim resolutions.

AI-Driven Features

The AI system in the insurance claims processing framework is designed to optimize every facet of claim resolution, integrating advanced capabilities for accuracy, efficiency, and compliance.

Key Findings:

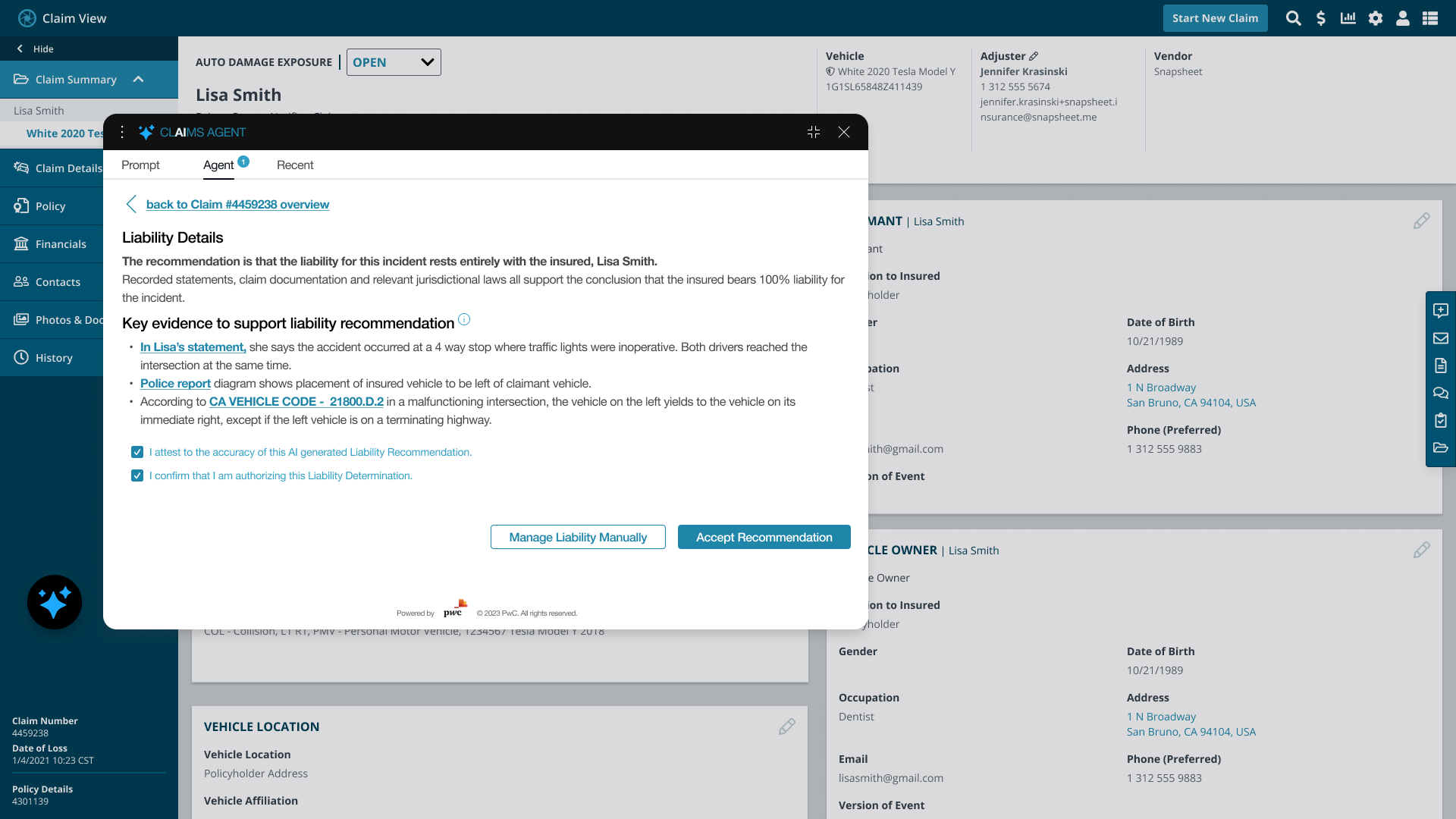

- Analysis & Liability Recommendations: Conducts comprehensive analysis of key evidence like recorded statements, claim documentation and jurisdictional laws. Offering precise liability recommendations.

- Contextual Analysis & Compliance: Analyzes document contexts and cross-references data to ensure legal compliance and identify potential fraud, establishing claim accuracy.

- Automated Communications & Insights: Simplifies communication by automatically sending settlement emails and providing adjusters with insights into liability and outcomes.

- Efficient Payment & Services Coordination: Enhances efficiency by streamlining payments, accurately estimating repair costs, sourcing affordable parts, and arranging rental cars, all aimed at improving the claimant experience.

- Machine Learning for Improved Accuracy: Uses machine learning to continually refine its processes, boosting the system’s accuracy and decision-making with ongoing adjuster input and claim data.

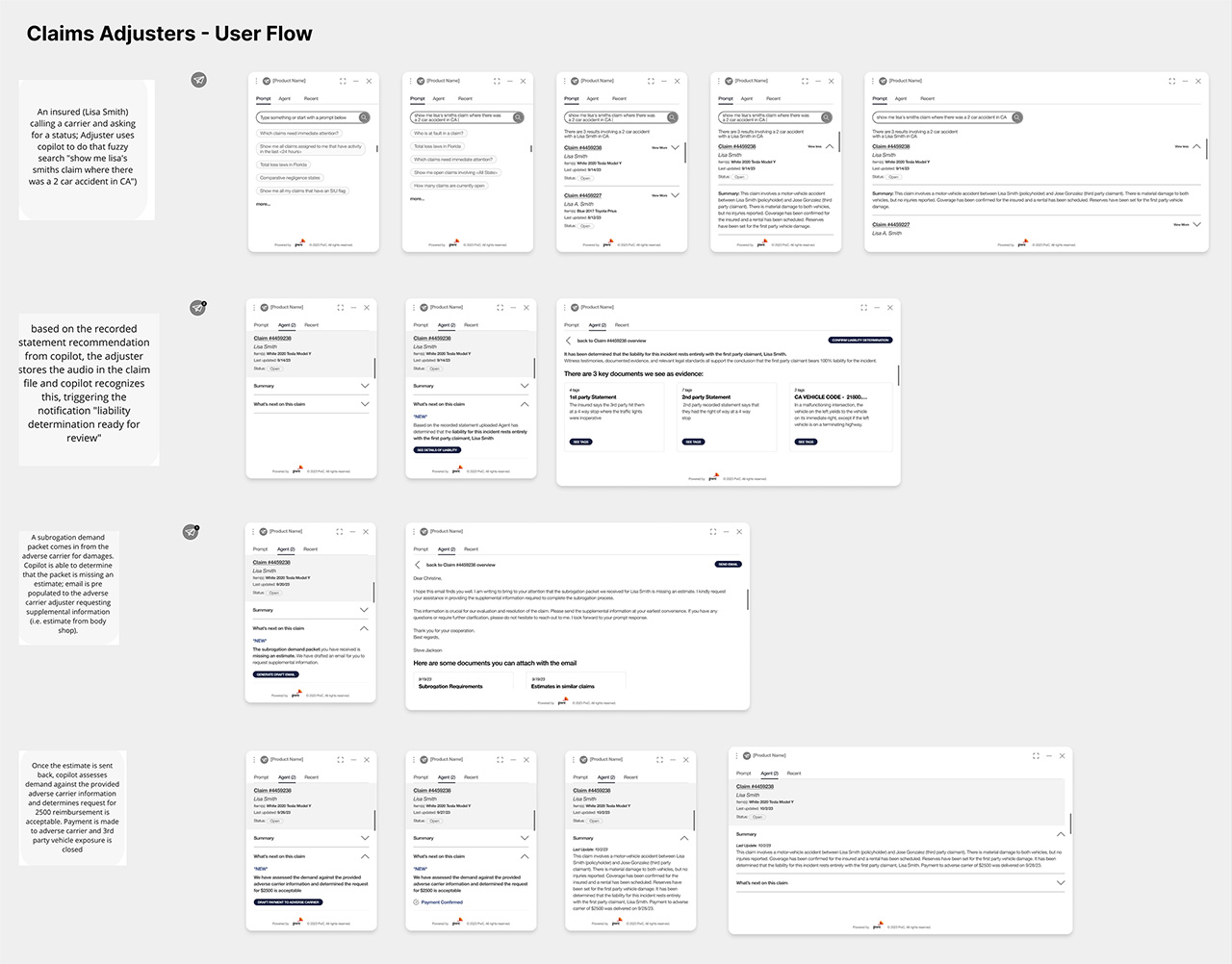

User Flows

Wireframes

Design

Tasks:

Developed Prototype

Conducted User Testing

Built High-Fidelity Designs

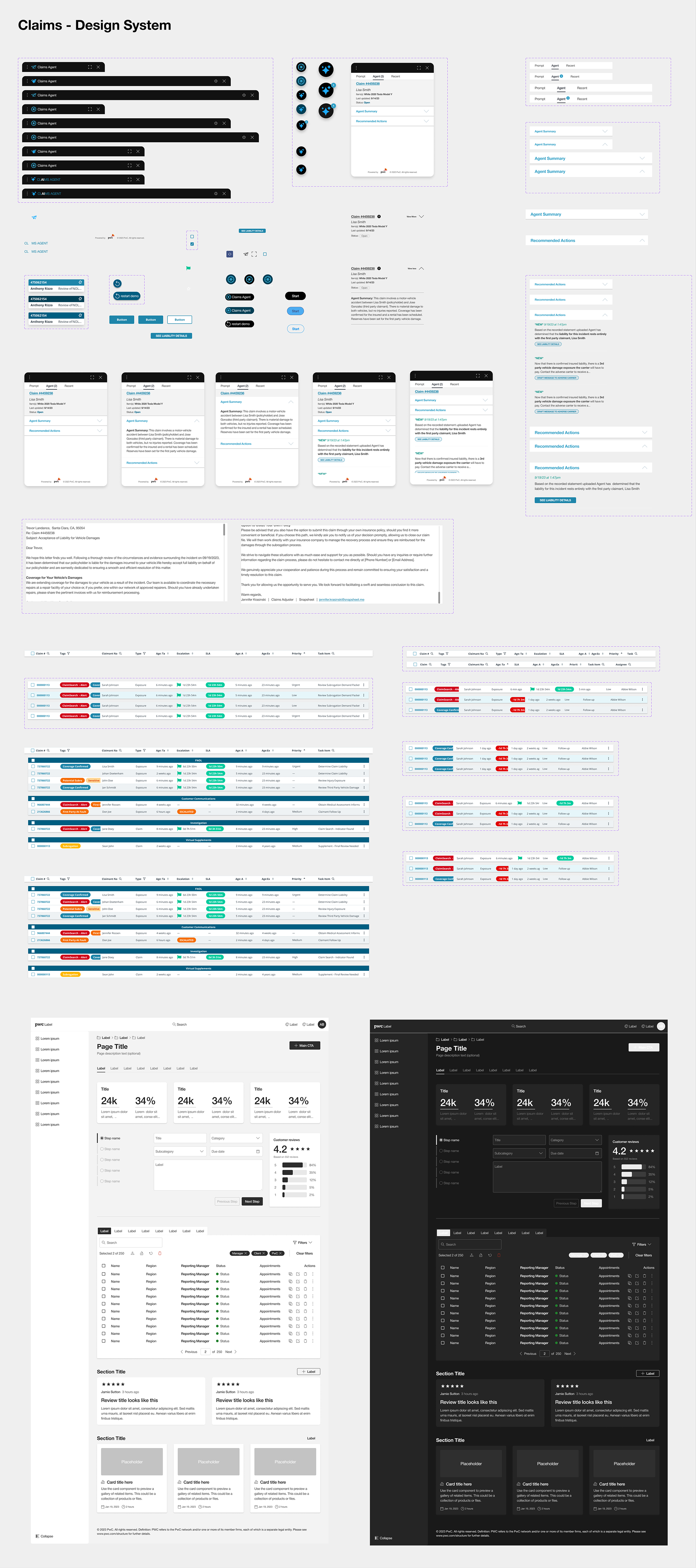

Created Design System

Prototype & User Testing

Key Findings:

- Positive Feedback on AI-Driven Insights: Adjusters appreciated the accuracy and usefulness of the AI-generated liability recommendations and cost estimations, which significantly aided their decision-making process.

- Streamlined Workflow: Users found the system’s streamlined workflow and intuitive interface made it easier to manage and process claims efficiently, reducing the overall time spent on each claim.

- Improved Communication Tools: The automated communication features were well-received, as they simplified the process of sending clear and consistent emails to claimants, enhancing communication and transparency.

- Need for Enhanced Training Resources: Some adjusters indicated that they required more comprehensive training materials to fully utilize the system’s advanced AI features, highlighting a need for better onboarding support.

- Adjustments for Data Presentation: Feedback suggested that the presentation of some data could be clearer, prompting design adjustments to improve the readability and accessibility of key information on the interface.

Project Outcomes

Key performance indicators (KPIs) are based on 3 months of user data collected from Claims Adjusters and company analytics.

Claims Adjuster Impact:

- 31% Enhanced Claims Efficiency: Streamlined workflows reduced the time required to process each claim, improving overall adjuster productivity.

- 79% Improved Communication: Automated features ensured clear and timely interactions with claimants, elevating customer satisfaction.

- 23% Improved Accuracy: AI-driven tools enhanced liability assessments and cost estimations, reducing errors significantly.

- Onboarding Tools: Simplified the learning process, enabling adjusters to quickly adapt to the system and focus on their tasks.

Business Impact:

- 79% User Satisfaction: High satisfaction rates reflected the system’s ability to improve communication with claimants and enhance adjusters’ daily workflows.

- 47% Improved Usability: The intuitive design and streamlined workflows significantly reduced cognitive load, enabling adjusters to focus on high-priority tasks.

- 27% Increase in Productivity: Adjusters handled more claims per week, thanks to efficiency improvements and a smoother claims process.

- Onboarding Tools: Training resources minimized downtime for new users, leading to faster operational readiness and higher productivity.

Knowledge Gained

- Leveraging AI for Operational Efficiency: AI can improve decision-making and streamline tasks. In future projects, I’ll focus on user-friendly AI integrations to boost efficiency while minimizing friction.

- Feedback Loops are Key to Improvement: Regular user feedback drives meaningful design improvements. I plan to use structured feedback systems in future projects to keep solutions relevant.

- Balancing Automation with Human Insight: AI and automation bring great benefits, but human input remains essential for nuanced decisions. I will design systems that pair automation with critical human oversight.

- Change Management is Critical: Introducing new systems requires careful planning to ensure adoption and reduce resistance. I’ll integrate strong change management strategies in future initiatives.

- Continuous Learning and Adaptation: Systems must evolve with user needs and external changes. I’ll design flexible solutions that adapt effectively over time.

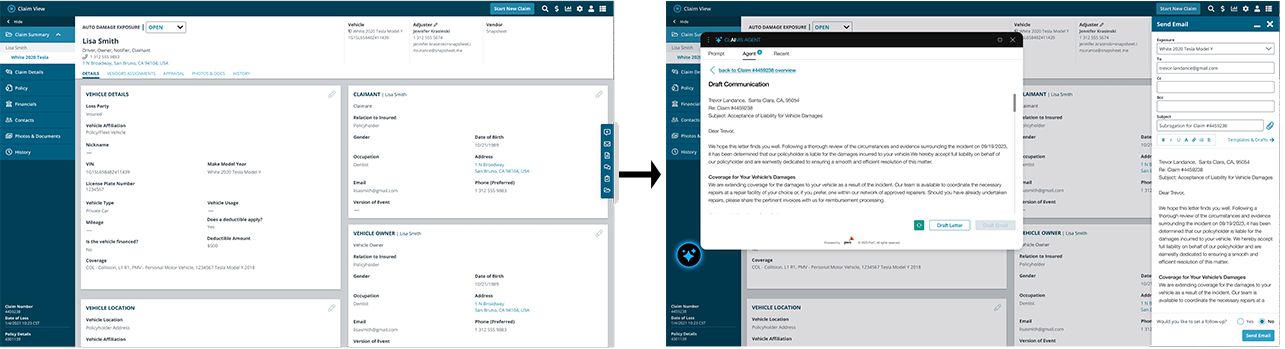

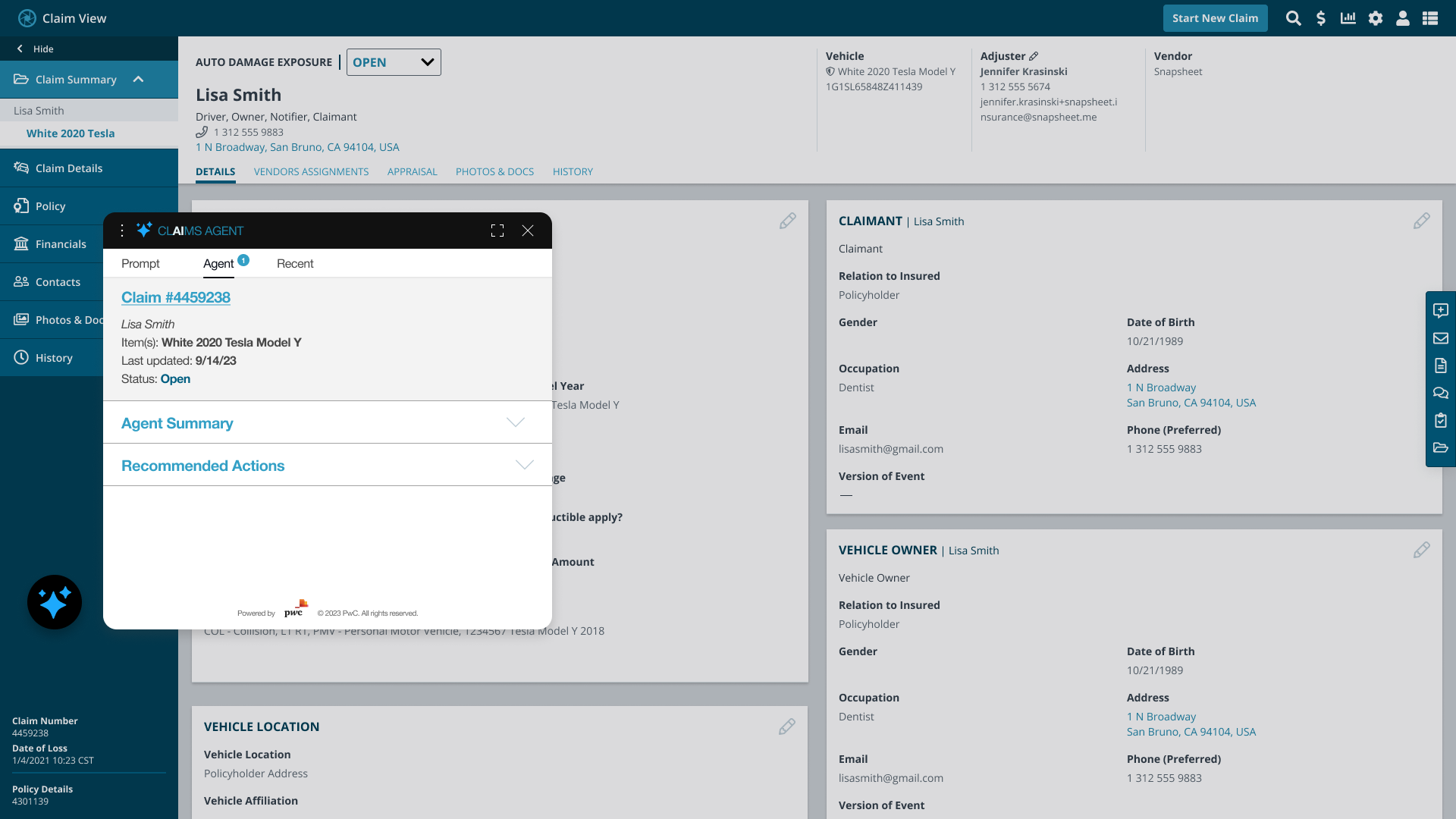

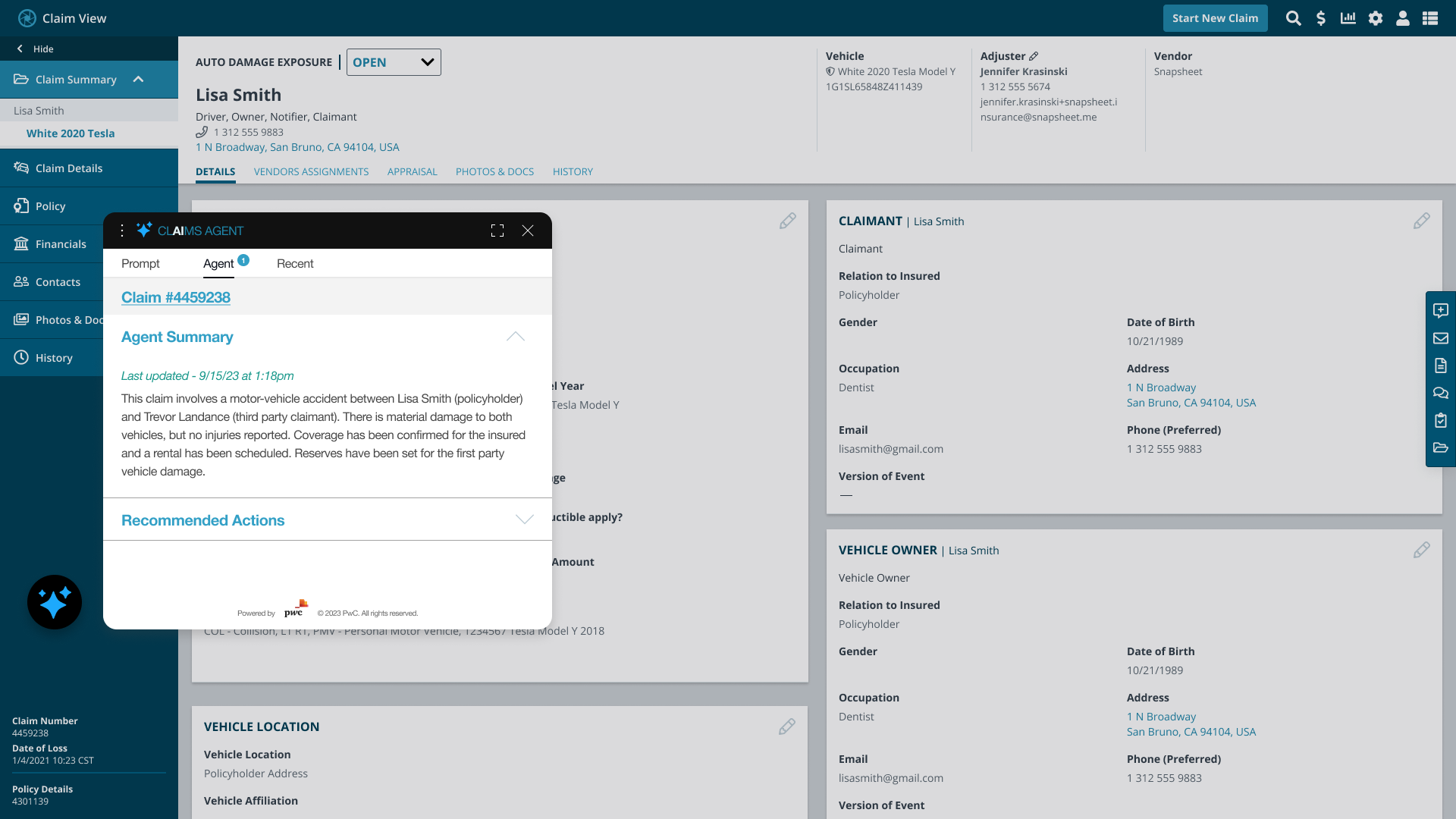

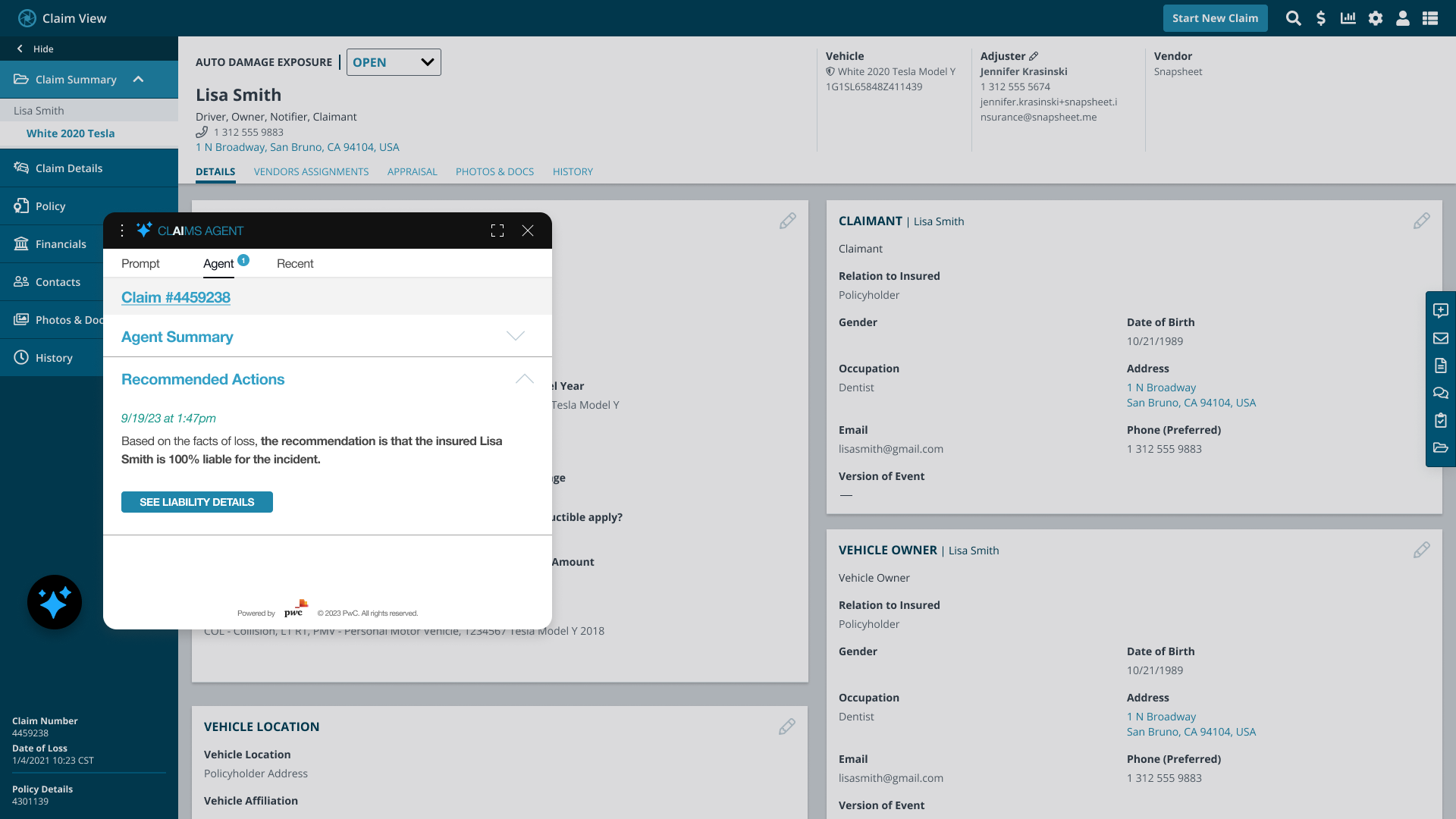

Final Designs

Claim Notification

Claim Overview Modal

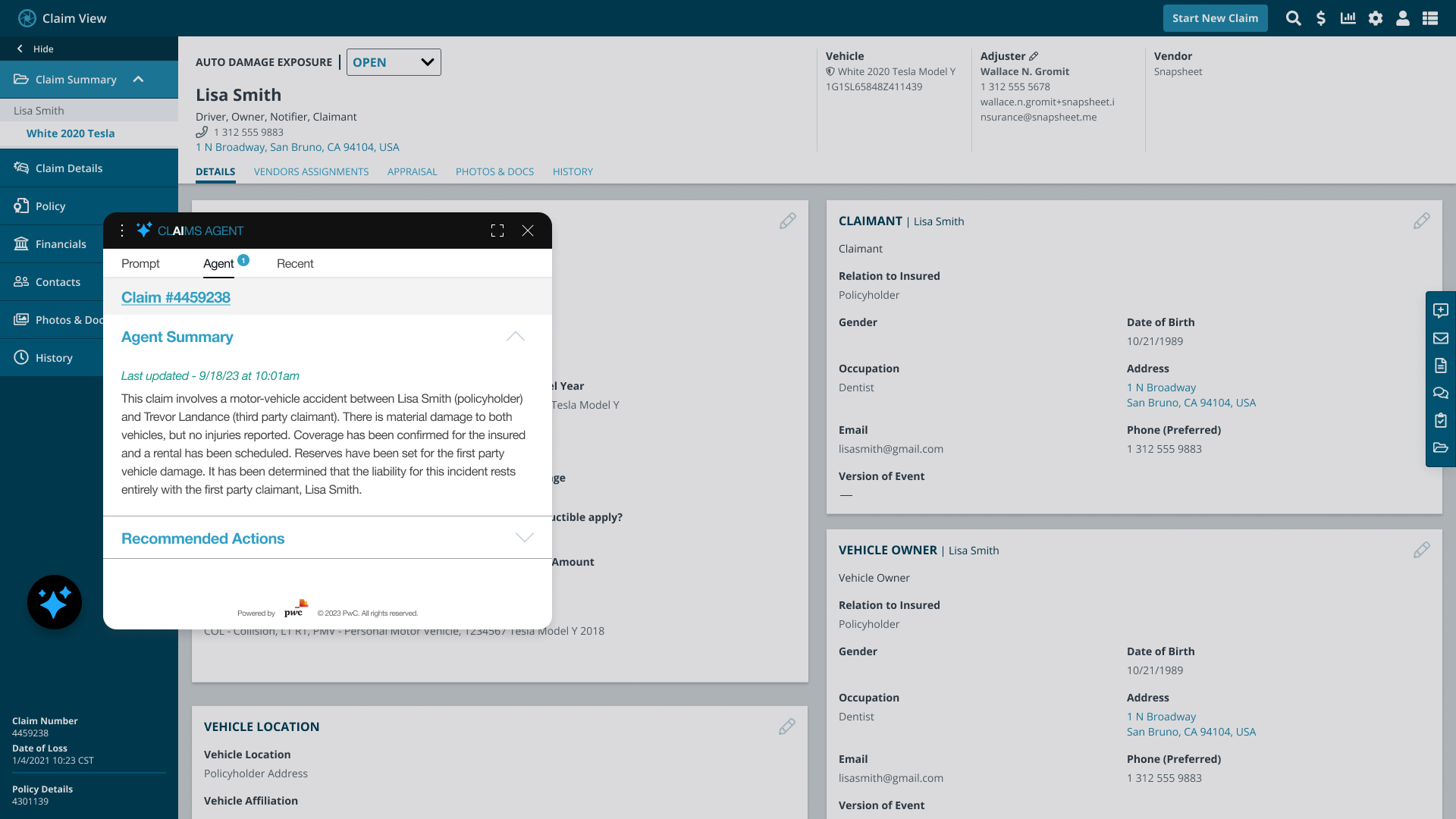

Claim Summary

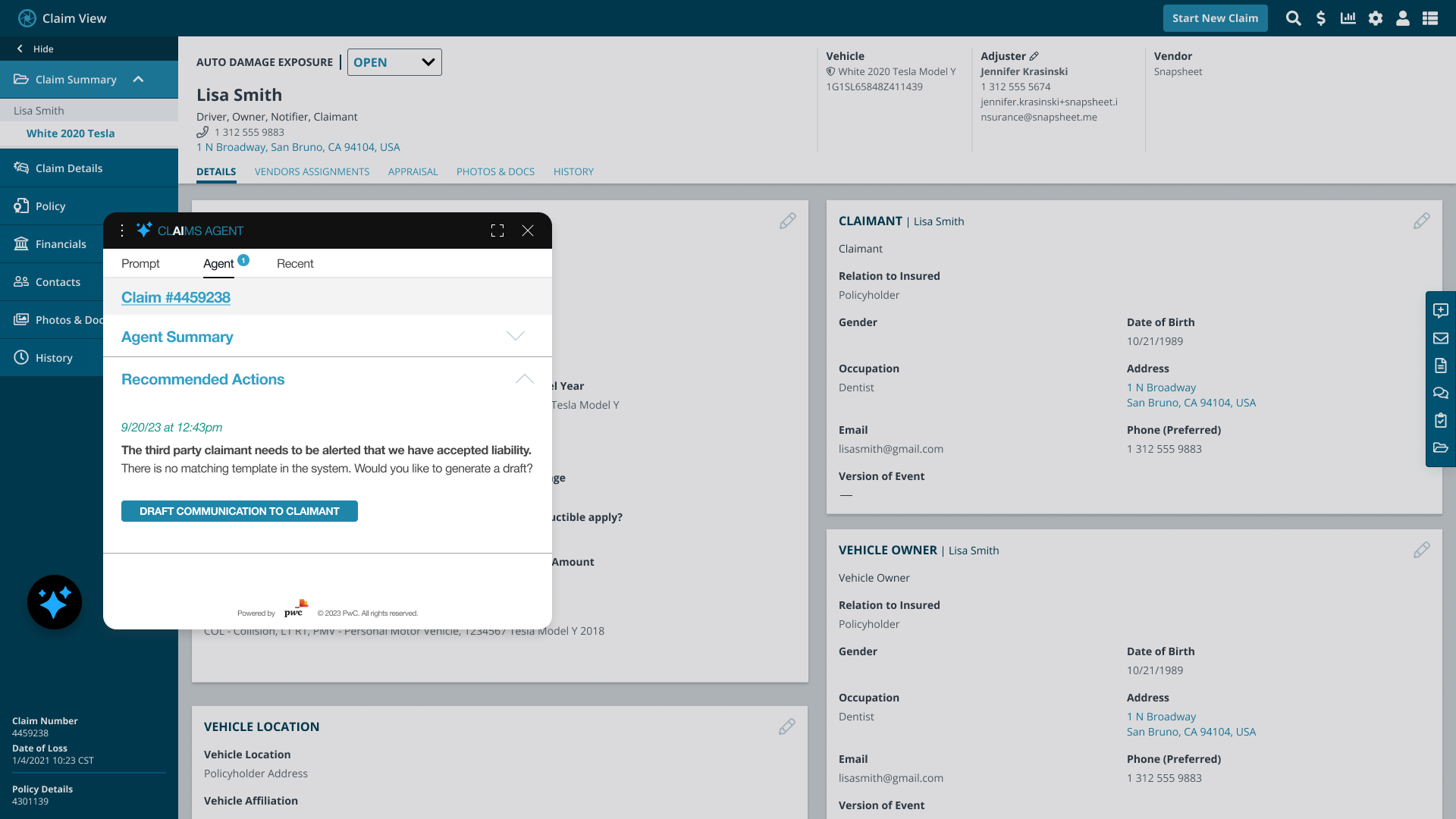

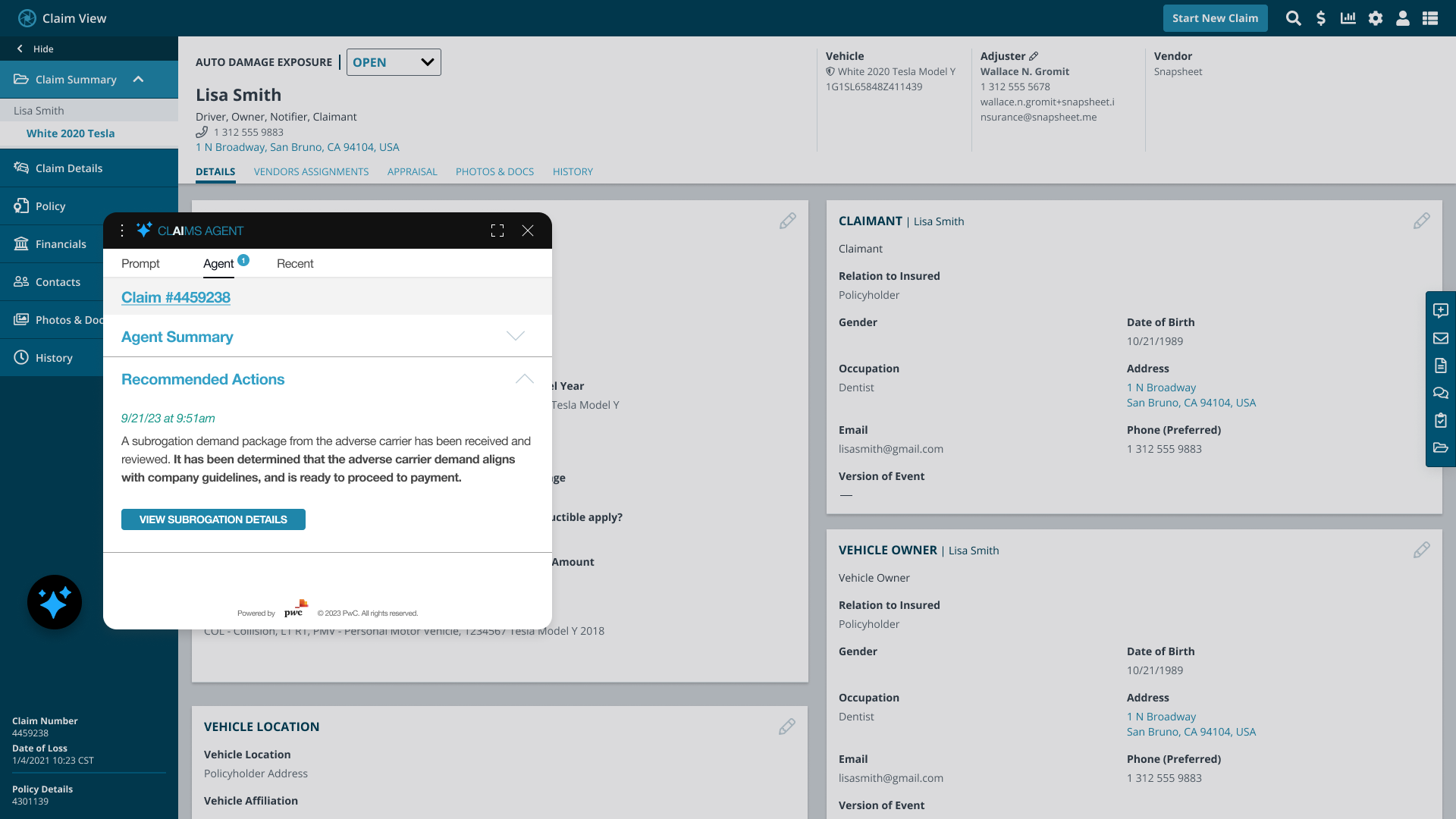

Claim Recommended Actions

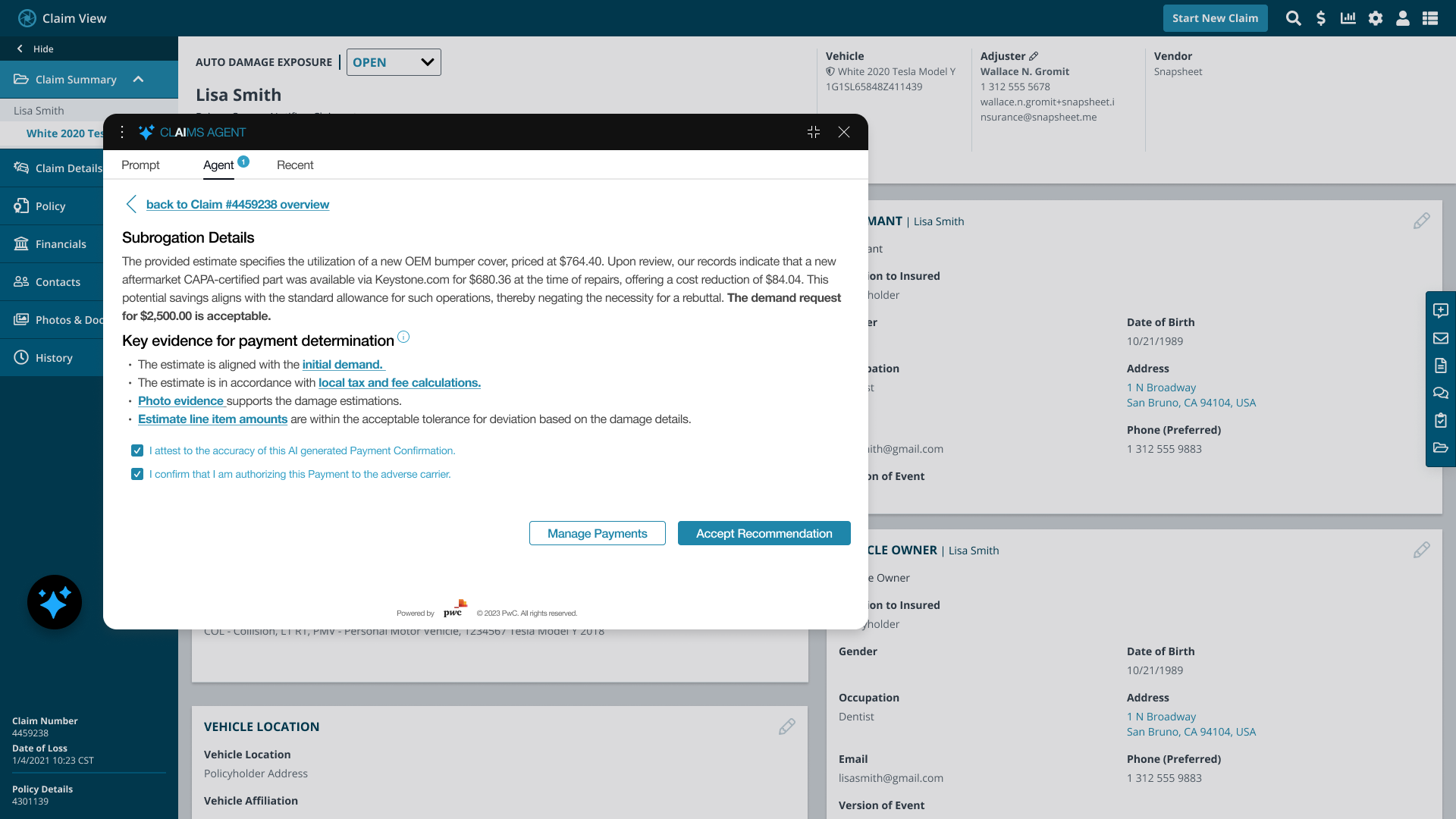

Claim Recommended Liability Details

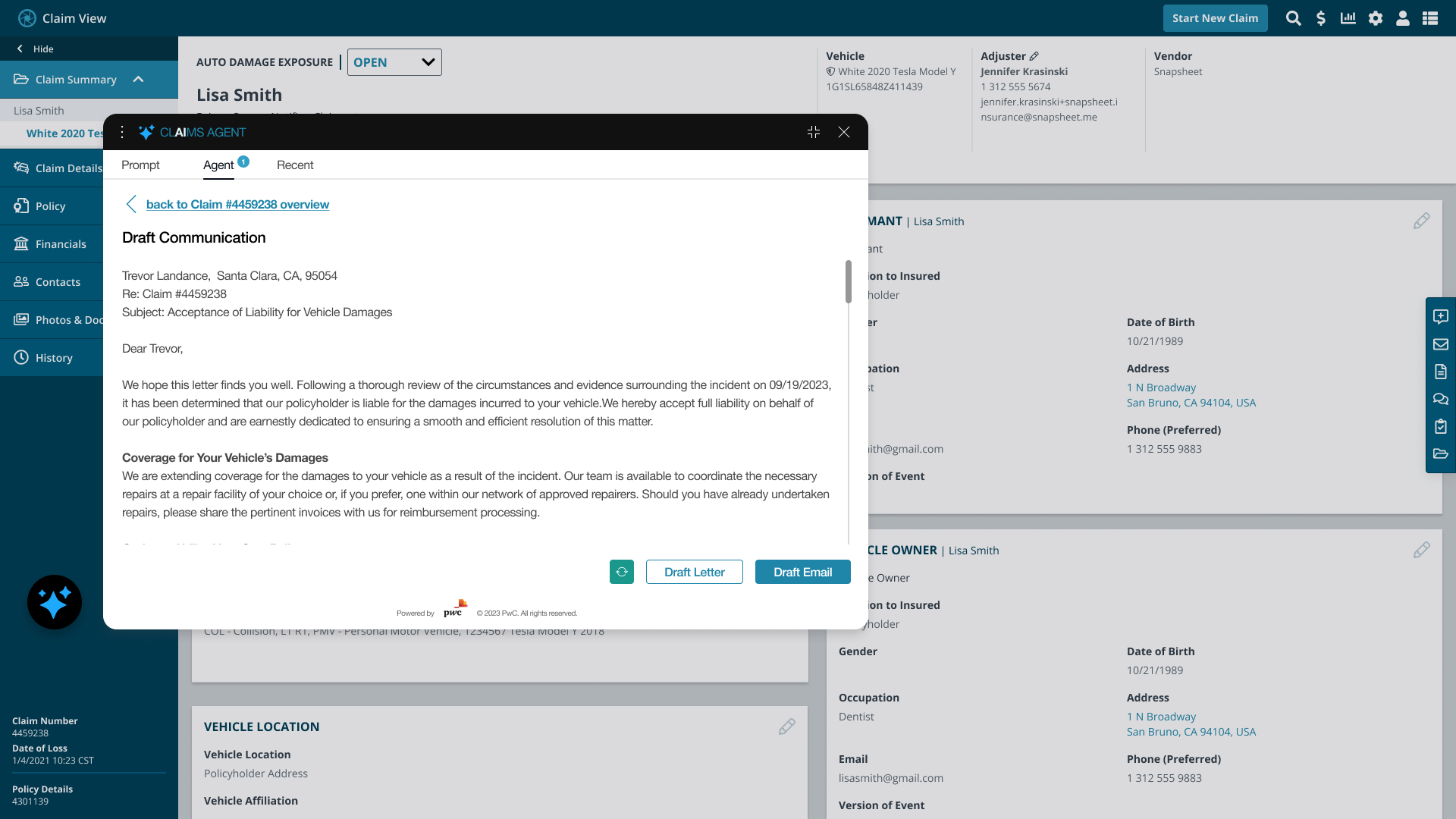

Claim Recommended Actions – Draft Email

Claim Recommended Actions – Draft Email Message

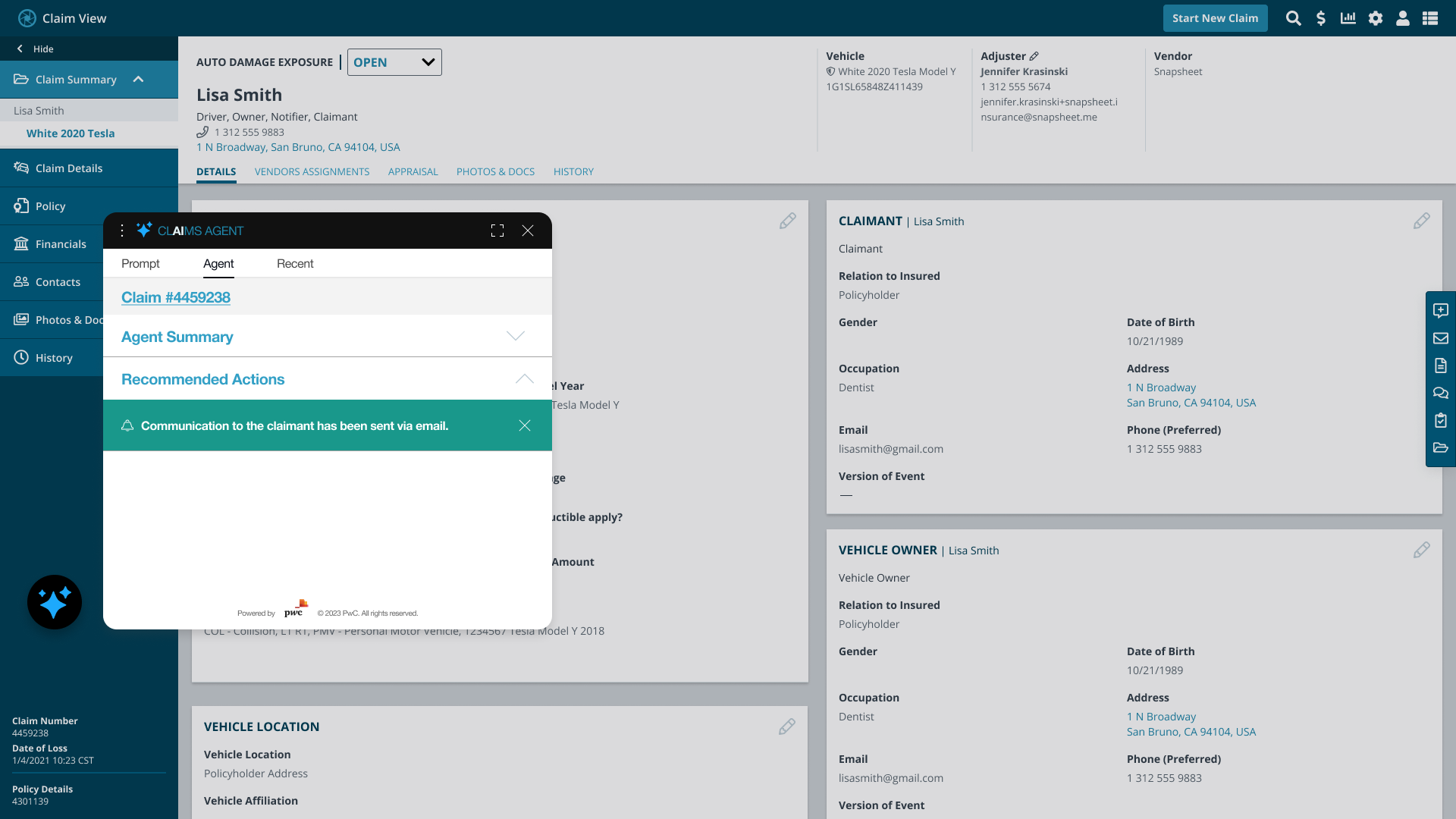

Claim Recommended Actions – Send Email Message

Claim Email Message Sent Confirmation

Claim Summary

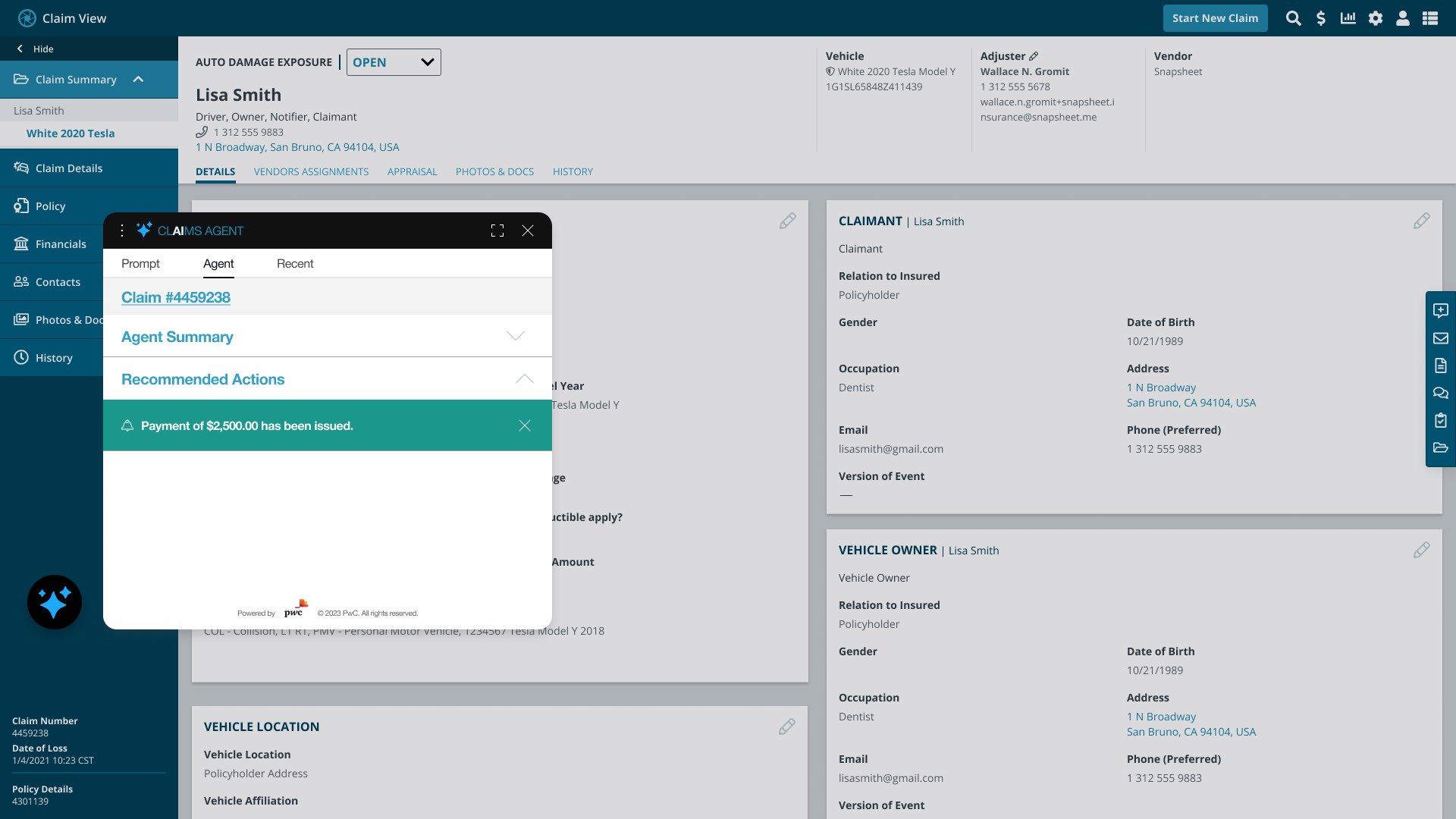

Claim Recommended Actions

Subrogation Details

Claim Payment Issued Confirmation

Design System